DO go chasing waterfalls!

Last month I rewarded myself with a trip to Italy to visit some friends and added a quick stop in Istanbul on to the tail end, because why not? This was my second trip of the year having gone to Hawaii in January and it likely won’t be my last. I tend to travel about 3 times a year and there is a very good reason for it.

Personally, I’ve always believed that having adventures and creating memories leave a longer lasting effect on my overall happiness in a very positive way. Recently a study that was headed up by Cornell University validated my beliefs on a scientific level. From the study they concluded that “experiential purchases (money spent on doing) tend to provide more enduring happiness than material purchases (money spent on having).”

As if you needed more inspiration to travel, in a December 2013 Buzzfeed article, they polled the aging/dying about their regrets in life and the #1 regret was not traveling when they had the chance. It gets much harder and more expensive to travel the older you get. This brings up a good point. When you are old and gray sitting in your rocking chair wearing your support hose and screaming at the neighborhood kids to get off your lawn (this is how I imagine myself by the way), are you going to regret the morning latte you gave up, or those designer shoes that you skipped, or even that sectional you had been eyeing? Probably not. So let’s skip the regrets and seek out happiness in the form of doing!

You may be thinking to yourself ‘Even if I do curtail purchasing these material things how can I travel…it is soooo expensive these days. If I fly, I have airline tickets and baggage fees, if I drive gas prices are ridiculous. How is it even possible?’ Well, here’s where I come in with a plan.

First, take a look at your monthly spending and see what material things you would be willing to give up to lay on the beach for a week, or to visit family you haven’t seen in years, or to wander the vineyards in Napa….you get it. Can you free up a couple hundred dollars? My guess is that, if it was for something you really wanted to experience, the answer would be an unequivocal yes! Now, every time you have the urge to purchase something you don’t need (Remember, if they have to advertise it, you don’t NEED it!) simply think about your upcoming trip or better yet, tape a picture of your desired locale to your debit/credit card. If you want to understand the fleeting emotions behind purchasing material items a little better here’s a quick read titled “The Science of Buying Happiness”.

Next, start planning! Take a look at airline prices, train tickets, rental cars, hotels, sight-seeing tours etc etc. This is all part of the travel experience and is very important in figuring out how much your trip will likely cost. Not only is it practical, it is really fun! You don’t have to do this all at once. It can be done over the course of time to help you stay connected to your savings goal for the trip.

Alright, suppose you now have a plan. You have decided you are going to Italy and your target budget is $3000.00. Perhaps you are now saving $300 a month towards this trip and in just 10 months you will be ready!! Or maybe you can only put aside $200 a month and your trip is a year and 3 months out. Even better, now you have more time to plan and more time to look for deals by booking ahead of time.

Now imagine that the day is finally here! Your suitcase is packed, you are ready for the adventure of a lifetime. If you are like most people, including me, the minute you venture into vacation mode it tends to turn into a free for all. How many of these have you heard or thought to yourself before? “You only live once!” “When am I ever going to be in Italy again?!” “I worked so hard to get here, what the heck, why not?” Those are all true statements, however if we give into them and splurge while we are on vacation this amazing experience that we had so much fun planning and saved so diligently for, could easily turn into a mountain of debt and a pile of misery when we get home and back to reality. That does not equal happiness.

How to travel on a budget.

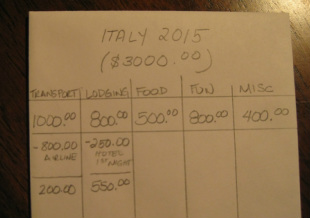

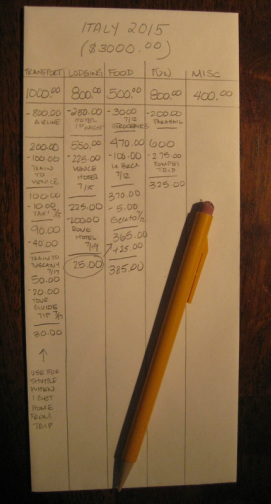

How to travel on a budget. Here is an easy way to kick vacation brain to the curb to make sure you come home with lasting memories (and maybe a tan?) and not a huge credit card bill. Before you set out on your adventure, grab an envelope. It can be big or small. This is where you are going to stick all the receipts you get handed and keep track of all the cash you spend while you are traveling. Now, let’s write a few things on the outside of the envelope. At the top you can write ITALY 2015 (or whatever you are calling your trip) and your full budget amount. Below that we are going to create some categories. These are up to you with how detailed you want to be but I do recommend creating a handful of categories and not just lumping everything into one. Trust me, if you lump everything into one single category you won’t use this method and will come home having spent more than you intended. In my example pictured above we have Transportation (planes, trains, automobiles and tips etc), Lodging (hotels, motels, tents etc), Food (restaurants, grocery stores, road side fruit stands etc), Fun (sight-seeing excursions, souvenirs, gifts etc), and don’t forget Misc. (for those things where you don’t know where to put them like ATM and bank conversion fees, etc).

Now let’s take that $3000.00 budget and divvy it up. You may have already bought your airline ticket at the price of $800 but are anticipating another $200 in transportation costs between taxis and trains so we will allocate $1000 to Transportation. Do the same with all the other categories. Now in the appropriate columns deduct what you have already spent before you even started your vacation.

Now you know how much you have to work with during your trip. If you keep this envelope handy as you travel and keep a running tab of what is left to spend (you can shift available funds from one category to another as you see fit) you will make smart money decisions ensuring an amazing HAPPY adventure full of lifelong memories to pull from in the future.

Now you know how much you have to work with during your trip. If you keep this envelope handy as you travel and keep a running tab of what is left to spend (you can shift available funds from one category to another as you see fit) you will make smart money decisions ensuring an amazing HAPPY adventure full of lifelong memories to pull from in the future.