Aaron Gold (center, wearing black & holding my cute niece Ava) at the awards ceremony.

Aaron Gold (center, wearing black & holding my cute niece Ava) at the awards ceremony. This competition takes place once a year at Waimea Bay on Oahu provided that the waves are at least 40 feet high (20 feet by Hawaiian measurements since they measure the back of the wave and not the face) for the duration of the 8 hour competition. Unfortunately, since 2009 the waves simply haven’t been big enough to run it. The holding period for the Eddie begins in early December and runs through the end of February meaning the contest officials can call on the contest at any time giving the surfers 24 hours to get themselves and their teams to the North Shore of Oahu.

Luckily my brother lives on the North Shore of Oahu so getting there is not an issue for him. However, getting there is much more of a challenge for me but I wouldn’t miss this potentially once in a lifetime event for anything in the world. A last minute trip can be extremely costly, so how did I prepare for something like this financially?

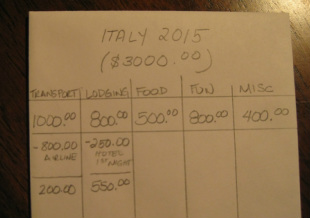

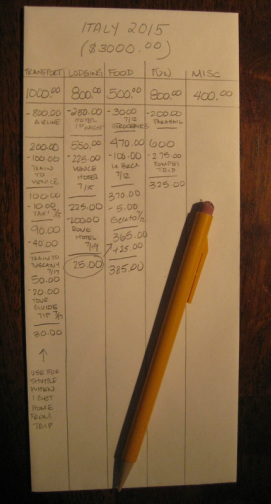

Every January I sit down and do my January spending plan, (a spending plan is like a budget but much more flexible taking into account life’s little surprises and the fact that no two months will be the same) but also my ANNUAL spending plan. The annual spending plan incorporates not only all my monthly anticipated expenses but all those add-ons that can’t be pigeonholed to one specific month like periodic expenses, savings goals, travel, home repairs etc. As I thought through my intentions and goals for 2016 I had high hopes that El Nino would bring the waves needed for me to finally witness my brother surf in this amazing competition. Because of this possibility I made sure to allocate a portion of my income this year towards traveling to Hawaii, and if you’ve read my previous blogs, you will already know I try to make it to Hawaii a few times a year anyway along with some other travel adventures sprinkled in for lasting good measure. So, when I got the call that the Eddie was finally going to happen on Feb 10th, 2016 I was stoked.

However, before I make any large financial decisions (and even smaller ones too) I always check in with my monthly spending plan to see what kind of concessions I may need to make later in the month if I want to make something unexpected happen. Fortunately my February spending plan had a little wiggle room to absorb most of these extra travel costs. I did have to give up those pair of jeans I wanted to buy and a few dinners out along with what I had planned on saving; not including my periodics savings of course) but these things were a small price to pay and the decision was easy.

So, I jumped on a flight the very next day and as often happens in life, this trip didn’t exactly go as planned. We got to the beach in the early morning twilight on Feb 1oth ready to watch the amazing surf and by dawn the officials had called it off. The waves were simply too small and everyone was sent home. Such a huge bummer. As quickly as it started, it was over, but I did get to spend time with family which made the trip worthwhile and I came back to LA with a tan which is a bonus!

What I couldn’t predict was what happened next. On February 22nd, I got another phone call. It was my brother telling me that the officials were going to try for take two. The Eddie was on (again!) for Feb 25th, 2016. I hesitated for a moment... could I really reschedule client appointments, arrange for dog care, and get back on a plane just 10 days since my last flight back from Hawaii?!?! It seemed insane to go but I couldn’t dodge the feeling that if I didn’t go I would always regret it. Again, instead of letting my emotions make my decisions for me (although I never completely ignore them- there are some things in life more important than money) I consulted my spending plans. Had I simply gone back to my February spending plan the answer would have been an unequivocal NO!! The first trip was barely squeezed out of the February budget, let alone a second one. So I deferred to my annual spending plan, which confirmed the fact that if I stay on track the way I have planned this year, I can definitely afford this trip while sticking to all of my savings and investment goals too. It simply meant that this month I would dip into my savings to cover the added costs, but that I will be able to replenish that amount throughout the year, little by little. My annual spending plan said YES!! GO!! What the hell are you waiting for?!

So I did, I got on a plane the next day and I enjoyed every second of this last trip without any financial guilt or stress because I knew that I had planned on traveling this year and that the cost was already anticipated in my 2016 annual plan. The only caveat is that most of my travel for the year has now already happened in the month of February, which is absolutely fine by me. I got a front row seat to watch my brother place 10th in the world. The power and awe of being there in person was something well worth blowing the majority of my yearly travel funds on.

As you can see having a working annual spending plan (Where all money going out INCLUDING money being sent to savings, and debt payments = money coming in) allows you the opportunity to say, absolutely 100% yes, to chasing after adventures when they unexpectedly present themselves even when your monthly spending plan discourages it. My annual spending plan gave me full guilt free permission to chase my brother whilst he chased his waves, an experience I will never forget, and never regret emotionally or financially!

If you need a hand figuring out how to create a spending plan, either monthly or annually, what the next step is to keep you moving towards your financial goals, or if you simply need advice before making a big financial decision, make an appointment today and I will help you sort it all out.