Recently I came across a little story on the vast interwebs which really encapsulates one aspect of what I try to teach my clients. The blurb (source unknown…if you have any idea where this came from let me know) reads:

But my grandmother doesn’t live a life of scarcity, and her version of being frugal isn’t about depriving herself. Her apartment is overflowing with sewing supplies and her beloved kitschy art. She saved where she could and spent where she wanted. She taught me it’s ok to splurge on something that really matters, as long as I am being frugal elsewhere.”

It is my job to get to know a client both financially and emotionally to help you find a healthy balance between your spending and your saving. The most important element in achieving this is to start by tracking your spending. Where is your money going? What is it buying? Besides basic necessities, are you spending money on things that serve you (meaning things that help you reach a goal, either big or small, things that bring a sense of fulfillment to your life) or are you unconsciously spending money on things that you don’t really care about, things that push you further away from your goals leaving you feeling stressed out and emotionally empty? By tracking your spending, we can locate your “hot spots”- areas where you spend money on things that don’t serve you, and find ways to divert the spending to “low spots”- areas where you would like to spend money or where you will benefit most from spending money that seem to get ignored. In fact, likely by simply being aware of what your hot spots and low spots are, you will see a subconscious change in your spending habits going forward. However, sometimes awareness is simply not enough. Often we get stuck (addicted) to unhealthy spending and it’s hard to break out of the routine. This is where a money coach is invaluable. A coach will help you approach these habits from the perspective of “How can I achieve the same end result for less or no money?”

Let’s use my personal experience as an example. Before I became a money coach I always felt compelled to donate money to non-profit organizations that I believed in. Somehow, even though I was making great money I never seemed to get around to donating. In looking back, I know the reason I “never got around to donating” was because my money was being diverted to my hot spots instead and I never felt I quite had enough extra to donate. For me, donating was a low spot- something I wanted to do, something I knew would provide fulfillment in my life, but something that was being steamrolled by my hot spots.

By tracking my spending I was able to isolate the fact that if I were to cut down on my clothing expenses I could free up money to shovel into my low spot. But I like clothing, and as you can imagine from my previous career being surrounded by very expensive clothing day in and day out my taste is expensive. In fact, my favorite brand is Theory. So the question was, how could I cut down on my clothing spending when the things I like are really expensive? Well, as a money coach I know that simply going out and buying cheap knockoffs is not going to serve me in the big picture. Likely the knockoff is not made well, the fabric will be synthetic and not feel good against the skin and chances are I will lose interest in wearing it and simply purchase something else to replace it anyway…bringing me right back to where I started. Does that mean I A) just don’t buy anything at all because why buy a knockoff if I know it’s a circular pattern or B) go ahead and splurge on the clothes I want and simply continue to ignore the low spot in my life?

Surprise, trick question, the answer is C! This is where I put on my frugal badge and wear it (pun intended) like a champ! Instead of picking A or B, I got creative and found a way around this dilemma. I now find the things I like from Theory on ebay often for a fraction of the price and still with the tags on. This is a win-win solution! I get the exact well-made clothing that I want, clothing that I know will last a long time and get repeated use, and I have now freed up money to donate. I have filled both a want (clothing) and a need (fulfillment from making a donation and a difference) simply by being frugal about how I spend my money and it feels GREAT!

Recently I had a client tell me an incredible story of how being frugal changed their lives. By tracking their spending this client realized they were spending more money than they thought was reasonable on Perrier. In wanting to achieve the same result (being able to continue drinking their bubbly water) but by doing it “for less or no money” they decided to invest in a Soda Stream and make it at home. In the long run this would save them money that could then be diverted towards a low spot in their lives. But it gets better, in recent months this client had been very sick with kidney stones but when they switched to homemade bubbly water they noticed a vast improvement in their health, all of a sudden they were starting to feel better. In relaying this connection to the doctor they discovered that the high mineral content in the copious amount of Perrier they had been drinking had been the underlying cause of the kidney stones! In this instance, being frugal didn’t just save them money, it changed their lives significantly!

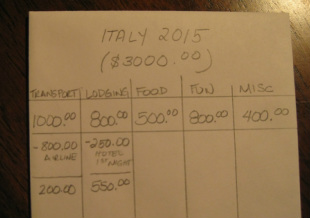

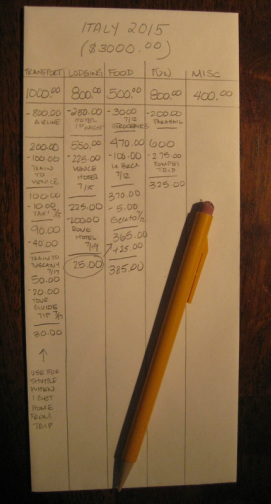

Granted not all stories about being frugal are going to be that impressive, or that dramatically life altering. Sometimes being frugal simply means stocking up on items that you use because they are on sale as opposed to buying them one at a time at full price. (Remember buying things you don’t need or don’t already use simply because they are on sale or you have a coupon is not being frugal. Need a refresher? Click here.) It could simply mean trading mediocre meals out for fantastic meals at home (or even mediocre meals at home for that matter). Sometimes it is renting a movie instead of going out to a movie, or making coffee at home instead of buying a latte. Figuring out how you can be frugal in the areas that don’t matter to your bigger picture can actually be fun, especially when the payoff is fulfilling something in your life that was constantly out of reach in the past. Maybe that low spot is a vacation, or a house fund or even making a dent in old debt.

So I challenge you, going forward, how can you meet your financial goals and fill your emotional needs/low spots for less or no money?

If you are stuck and need a helping hand to figure out what your hot spots and lows spots really are, if you want to start tracking your money but don’t know how, or if you simply want advice when making a big financial decision, make an appointment today and I will help you sort it all out.